Acquisition Project | JioCinema

JioCinema - Product Showcase

What is JioCinema?

- One of the largest over-the-top (OTT) platforms in India, with a scale unmatched. The streaming service is owned by Viacom18 media house. It has a freemium model offering both free (with advertising) and subscription based video on demand and live streaming content.

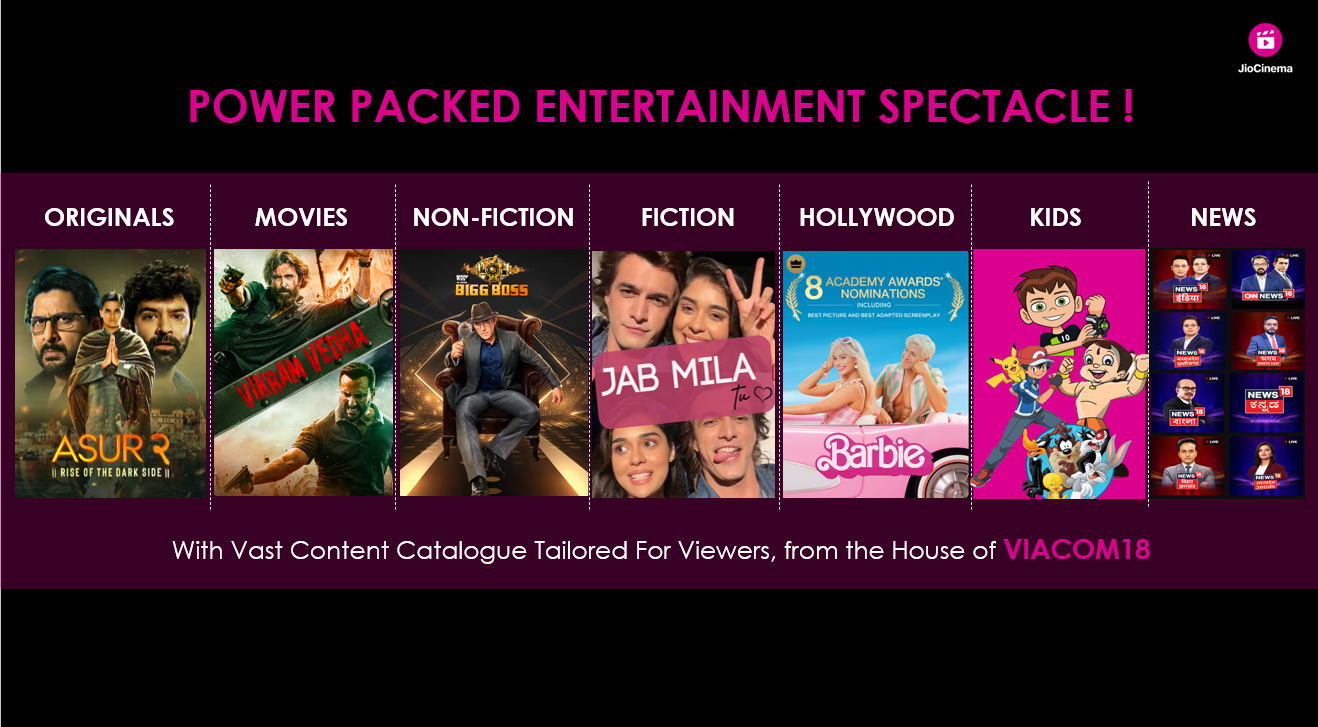

- JioCinema boasts of being the top Sports & Entertainment destination for Indians, at the back of the power of its content that includes sporting events like IPL, Olympics, WPL, FIFA and entertaining shows such as Bigg Boss, Hollywood (HBO, Paramount, Warner Bros), Originals (Asur, Illegal, Inspector Avinash, Taali), and movies

- The platform has hosted two IPL seasons, which showcases the PMF and scale of the business it has already reached > has been leading the OTT wars in the country. The audience numbers can shown below. At the back of this, JioCinema fits to be in the mature-scaling stage

As JioCinema is a big entity in itself, with various business units including Sports, Entertainment and within Entertainment, they have Advertising VOD & Subscription VOD. I would be focusing on the Entertainment AVOD vertical.

Context of the study

JioCinema garners ~300Mn MAUs due to the immense viewership witnessed during the IPL period. (Include the video watchers funnel). The platform gets the maximum eyeballs and active users on the back of free streaming of sporting events. But the story doesn't remain the same during the non-IPL months, especially for the Entertainment vertical. The MAUs to MEVVs ratio significantly decreases during this time period, leading to lower platform users, lower watch times, lower advertisers and hence, lower revenues.

Objective: To acquire more audiences on to the platform (especially during the non-IPL days)

Product screenshots of the User Flow

Home Page (App)

Home Page (Web)

Entry Point from the Main Menu

Entry point from top menu

Entry point from channel tray

User Understanding

To get a better understanding of the current platform (Entertainment) users and to get a mental model of their behaviors, motivations, and pain points around content consumption, 5+ user interviews were conducted. Below are the set of ICPs documented.

ICP Framework

| ICP-1 | ICP- 2 | ICP- 3 | ICP- 4 | ICP- 5 | ICP-6 | ICP-7 |

|---|---|---|---|---|---|---|---|

Who are they? | Working Professional | C-Suite Executive | Parent | School kid | College Student | Blue-collar worker | Retired |

Age | 25-35 | 40-50 | 30-50 | 7-12 | 18-24 | 25-40 | 60+ |

Gender | Any | Any | Female | Any | Any | Male | Any |

Location | Tier 1 | Tier 1 | Tier 1 | Tier 1 | Tier 1 | Tier 1 | Tier 1 |

Occupation | Salaried Professional | CXO | Homemaker/ Non-salaried | School going | Student/ Intern | Gig worker | Retired |

Income | ~25-40 LPA | >50 LPA | NA | NA | NA | ~3-7 LPA | NA |

Relationship Status | Any | Any | Married | Unmarried | In a relationship | Any | Married |

Lives with | Alone, Flatmates | Family | Family | Family | Friends, Hostel | Alone | Family |

Where do they spend time? What are their interests? | Work: 40-60 hrs/ week | Work: 50-80 hrs/week | Parenting & Household: 40-50 hrs/week | School: 30 hrs/ week | College: 40 hrs/ week | Work: 60-80 hrs/ week | Spends time on managing work for the gated society, attends spiritual and community sessions with fellow elders in the society. Other time is spent on watching videos and going through Social Media platforms, along with gaming sites (Ludo, Tambola) |

What avenues do they look for to entertain themselves, when bored? How many times a week do they take actions to address boredom? | During work breaks, quickly browses through Social Media sites to check up on the new happenings and posts by friends. After work: Watches content on YT or OTT for dinner. Sometimes, also reads non-fiction before going to bed, to keep his day productive. Frequency: Everyday, multiple times. High frequency during weekends | Doesn't get much time during the day. To relax, prefers reading, catching up on news, sporting events and taking brisk walks. Watches content while travelling for work and family. Frequency: 3-4 times a week, as the days are jam packed and hardly any time is left for leisure activities | Gets free only by late evenings after dinner, prefers to catch up on dance, singing and other drama reality shows. Also pretty active on IG, FB to see the new trends in skincare, beauty & personal care. Frequency: Everyday, mostly during the evenings (Me times) | Plays with friends after school, watches recent episodes & movies of superheros/ sci-fi/ fantasy world. Spends time during weekends, on family outings Frequency: Everyday, more so during weekends | Highly active on social platforms to be connected to friends & family. Goes out with friends, attend college parties/ fests, watches YT & OTT content to catch up on new web series, buzz-worthy shows and also go out for movies on days of free lectures. Frequency: Everyday, multiple times | High waiting times are spent majorly on watching reels on YT, videos on FB. Watches cricket matches and live updates. Frequency: Intermittently throughout the day, daily (Except during peak hours for delivery) | Spends time on reading newspaper daily, watching videos shared by fellow group members and family on Whatsapp groups. Likes to watch new videos posted on YT, FB. Catches up on all recent shows, especially reality shows and sporting events. Frequency: Multiple times a day, daily |

Which OTTs do they use for content consumption? What factors do they consider for choosing the OTT platform for content? | Has subscriptions for Hotstar, Amazon Prime, JioCinema, Sony LIV & Netflix Factors: Content type, time at hand, interest, social construct (with friends or family) | Hotstar, Amazon Prime, JioCinema Factors: Content type, genre interest, time available | Hotstar, JioCinema, SonyLIV Factors: Reality shows, comedy, family co-viewing content, not serious or gory web-series | Netflix & JioCinema Factors: Have sci-fi & superhero movies, easy to use and search content on platform | Hotstar, Amazon Prime, JioCinema, Sony LIV & Netflix Factors: Trendy shows, interesting plotlines, can be watched with friends and discussed with | JioCinema, Hotstar Factors: Sports events, free to use, regional content | JioCinema, Hotstar, Amazon Prime Factors: Has daily soaps, entertaining content, more variety to choose from |

Pain Points: What are the challenges they face when streaming OTT content? | Too many options, takes time to find the right content | Interesting content availability, downloadable content that can be watched while travelling | Choosing good quality content that is lively & comic, something that all family members enjoy | NA | Missing personalization, inability to watch with friends | Good regional content, affordable plans | NA |

How did they get to know about JioCinema? | Through work colleagues who were using it to watch IPL | Searched online to watch IPL | Newspapers ads | Family member or friend | Friends, social media platforms | Colleagues & friends | Friends, newspaper |

How often do they use JioCinema & what do they primarily watch on the platform? | 3-4 times/ week Hollywood movies & web series like Game of Thrones, House of Dragons | 1-2 times/ week Sports, Web series | 2-3 times/ week, everyday when Bigg Boss comes Reality shows (Dance Deewane, Bigg Boss), Hindi movies | 5-6 times/ week Marvel movies, cartoons, Pokemon, Ben10, Harry Potter | 4-5 times/ week Shows like Hustle, Splitsvilla, Roadies & Hollywood series | 3-4 times/ week daily during IPL News (regional), IPL, Marathi shows/ movies | 5-6 times/ week, daily during IPL Daily soaps, Bigg Boss, News, Mythological shows |

ICP Prioritization

| | Value To User | Ease of Adoption | Frequency | Appetite To Pay | CAC |

|---|---|---|---|---|---|---|

ICP-1 | Working Professional | High | High | High | High | Med |

ICP-2 | C-Suite Executive | Med | Med | Low | High | High |

ICP-3 | Parent | High | Med | Med | Med | Med |

ICP-4 | School Kid | Med | Med | Med | Low | High |

ICP-5 | College Student | High | High | High | Med | Low |

ICP-6 | Blue-collar worker | Med | Med | High | Low | High |

ICP-7 | Retired | High | Low | Med | High | High |

Prioritization Reasoning

- Based on the above framework prioritizing considering high value, easy adoption, high frequency, low CAC, the ICP are being narrowed down to two cohorts-

- ICP-1: Working Professional

- Highly aware ICP who is looking to get out of the daily working routine and wants a product that solves their need for entertainment. Generally stick to their acquired tastes, interests and genres, while also being open to watch other unknown genres

- Biggest part of TAM and have high appetite to pay. Once acquired, this ICP can contribute to high platform active users

- Due to the big TAM, variety of content categories & genres is essential for them

- Influencers- Office colleagues, friends, family, review articles/blogs/videos

- ICP-5: College Student

- Constitute GenZs who are open to exploration and look towards shared experiences. Their interests are still being formed and they make decisions in consideration with their peers. Their watching habits also reflect the need to belong to the latest trends, especially as they are highly exposed to social media.

- Growing TAM and can be acquired in their habit-forming phase, which can ultimately contribute to high stickiness on the platform

- Although they have medium appetite to pay, the current pricing subscription is very economical (29 Rs/month) and is not a big price even for students

- Influencers- Friends, batchmates, social media influencers

JioCinema's Relevant Offerings for ICPs

JC solves the user pain points, by addressing them as below

- Accessibility: Users can access the platform across mediums (App, Web, Mobile web, CTV)

- Affordability: Freemium model with subscription tier of Rs. 29/month (Disruptive pricing)

- Availability: Top content available across genres and both in the premium & massy space (such as Hollywood, Bigg Boss). Old episodes and seasons of marquee/ nation-wide shows that are loved by people and like to go back to often

- Innovative Formats: 24*7 LIVE streaming, multi-cam recording, interactivities such as voting, quiz, polls

| Select Content Genre Preferences | Potential Relevant JC Shows |

|---|---|---|

ICP-1: Working Professional | Sports, Thrillers, Crime, Action, Fantasy, Mystery | Hollywood (Game of Thrones, House of Dragons, Succession, Suits); Web-Series (Murder in Mahim, Ranneeti); Movies (Oppenheimer, Fast & Furious) |

ICP-5: College Student | Drama, Romance, Comedy, Adventure/ Action | Reality shows (Bigg Boss, Hustle, Roadies, Khatron Ke Khiladi, Splitsvilla), Romantic movies (Twilight, Pride & Prejudice) |

Competitive Landscape

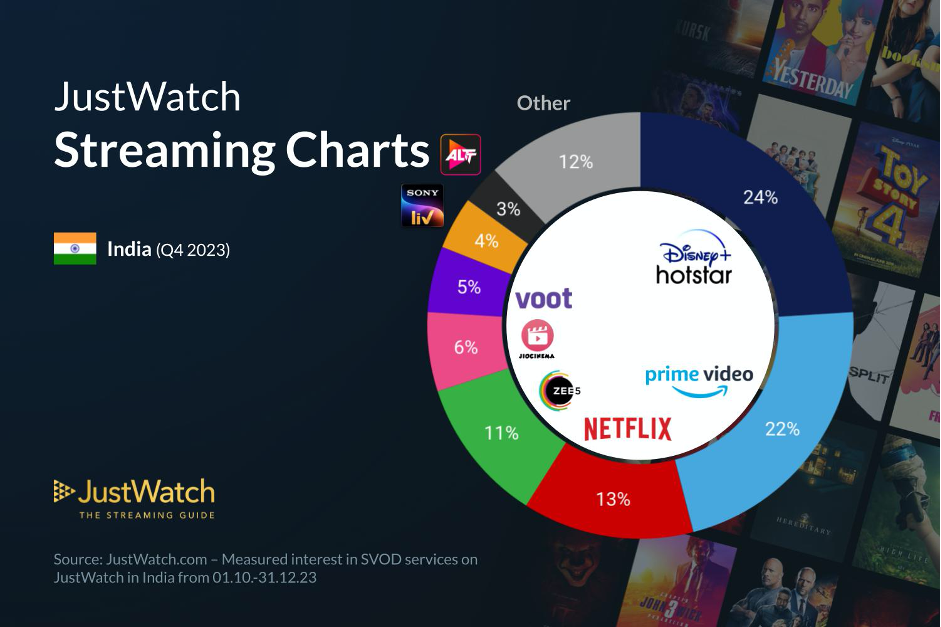

What is the Room For Growth?

Internet users in India (2024)= 760 Mn

YouTube Monthly Active Users = ~700 Mn

As per Ormax report 2023, there are 480 Mn OTT users in India (both free & paid users)

Clearly, there is a delta Total Addressable Market of ~200 Mn users that can still be targeted, especially on the back of disruptive pricing plan introduced by JioCinema (Rs. 29/ month)

Considering, only 50% of these would be converted to OTTs as a huge % can come from rural areas

Delta Serviceable Addressable Market = 50% * 200Mn = 100 Mn

Assuming, people have multiple preferences & can choose to take free tier options of other OTTs, % market share that can be captured for this delta is 20%

Delta Serviceable Obtainable Market = 20% of 100Mn = 20 Mn

Assumptions: Includes all mediums, OTT usage skewed towards tier 1/2 areas; users can have multiple subscriptions

Population of India = 1.4 Bn

% rural = 70%

% population preferring OTTs = 40%

Major OTT players = Hotstar, Amazon Prime, Netflix, SonyLIV, Zee5

Acquisition Channels

The OTT business showcases seasonality as the viewership on the platform is highly dependent on the kind of content available during a period of time. Case in point being IPL 2024 streaming on JioCinema, that garnered 620 million reach on the platform from Mar-May'24, which is the highest during the year. Popular shows and movies see a viewership spike as soon as they are launched (e.g., Squid Game on Netflix, Koffee with Karan on Disney+Hotstar) and then see viewership stability as the shows reach their shelf life on VOD (Video on demand).

To understand how audiences discover content available on JioCinema, below are the possible discovery points for a new user

- Search on Google/ YT/ other browsers, Smart TVs/ Firestick (Search Intent)

- Teaser/ Trailer Releases on digital channels (Content Loops)

- Paid & Sponsored Ads on various channels (Paid Ads)

- Print Ads in newspapers, magazines

- TV Ads on popular TV channels & shows (Star Plus, Colors, Sony)

- Digital Ads on social platforms (video for FB, IG, YT & display for Google)

- OOH Ads on billboards on the highways, in airports and other high-footfall areas

- Word of Mouth (Friends & Family)

Channel Prioritization for Scaling

Channel Name | Cost | Flexibility | Effort | Lead Time | Scale |

|---|---|---|---|---|---|

Organic Search | Low | High | Med | Low | High |

Content Loops | Low | Med | Med | Low | High |

Print Ads | High | Low | High | High | Med |

TV Ads | Med | Low | High | Med | High |

Digital Ads | Low | High | Med | Low | High |

OOH Ads | High | Low | High | High | Low |

WOM | Low | Low | Low | Low | Low |

Based on the above, in consideration for low cost, high flexibility, low effort, and high scale, the two channels that should be doubled down are: Organic Search & Content Loops

Almost 70-80% of new user acquisition in JioCinema is attributed to Direct & Organic Search

Organic Search

In organic, SEO approach to be taken, as most of the users generally search for shows, web series & relevant movies on Google. Objective is to scale customer acquisition volume.

Domain Overview

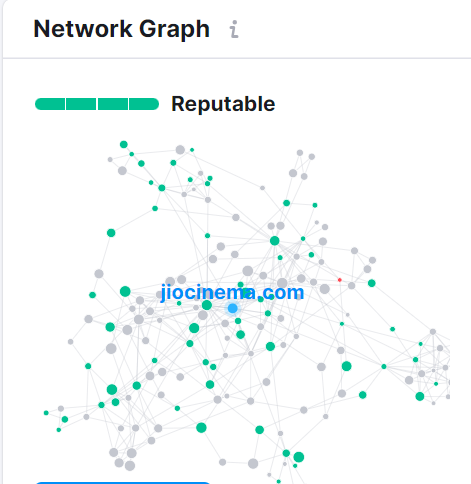

Checked the Authority Score on Semrush. JioCinema holds an Authority Score of 80.

It is a great score, but is still lower as compared to most of its competitors like Netflix (100), Amazon Prime (97), Hotstar (91), SonyLIV (79) . Below are the details.

netflix.com

primevideo.com

hotstar.com/in

jiocinema.com

sonyliv.com

The Authority Score has been consistently increasing over the last year, hence its not a matter of concern. Also, a Semrush backlink analysis shows that JioCinema has a high number of backlinks from relevant and reputable domains.

But to understand what isn't working, I ran a SEO site audit by crawling 100 pages of JioCinema's domain on Semrush to detect issues. Below are the major issues detected.

Issue | No. of pages | Category | What does this mean | Resolution |

|---|---|---|---|---|

Links with nofollow attribute | 60 outgoing internal links | Links, Crawlability | "nofollow" attribute is an element in an <a> tag that tells crawlers not to follow the link > link not passed to refer webpages | Not to use nofollow attributes, remove them from <a> tags |

Low text-HTML ratio | 23 | Indexability | This ratio shows the amount of actual text compared to code on the webpage. Triggered when ratio <10% as search engines have begun focusing on pages with more content. Less code increases page's load speed and helps in rankings | Split the webpage's text content and code into separate files and compare their size. If size of code file exceeds the size of the text file, review the page's HTML code and consider optimizing its structure and removing embedded scripts |

Low word count | 18 | Indexability | Triggered when no. of words on webpage is <200. Amount of text signals quality signal to search engines | Improve on-page content and be sure to include more than 200 meaningful words. |

No h1 heading | 15 | Meta tags, indexability | h1 headings help define the page's topics for search engines >missing h1 headings lead to lower rankings & breaks page's heading hierarchy | Provide concise, relevant h1 heading on each page |

Too much text within title tags | 9 | Meta tags, indexability | Search engines truncate titles containing more than 70 chars. Incomplete & shortened titles look unappealing & won't entice users to click | Rewrite page titles to less than 70 chars |

Keyword Analysis

I did a quick organic search analysis on the Google search engine on my mobile to get a drift of where JioCinema ranks for specific searches. As per my observation, JioCinema ranked in the top 5 search results for the marquee content searches. Below are the screenshots.

Then, I also analyzed organic search on Semrush to find a larger trend for the platform.

Organic Search has been picking up in the last one year but we see that JioCinema ranks in the top 4-10 search results 40% of the times, and ranks in the top 3 results 20% of the times.

Actionable > % for ranking in the top 3 search results must be increased. This would need better keyword analysis and optimization.

The following consists of keyword research done for JioCinema (Source: Semrush)

Observations/ Findings with Recommendations

- ✅ JioCinema has been doing extremely well in terms of its SEO strategy and execution when the search keywords are specific and targeted towards the brand or the various content available on the platform. Marquee properties like Bigg Boss, Asur web series, Oppenheimer and IPL matches show JioCinema's strength as it is top ranked, has very low difficulty to rank on SEO, with low to medium CPC

- ✅ SEO works great when the user has a clear intent in mind to watch specific shows or go to the Jiocinema web or app or live stream on the platform. JioCinema shows great rankings even when the search queries are around watching shows on specific channels (MTV, Colors) and regional languages (Kannada)

- ❌ The SEO strategy isn't working well when the search queries are generic in nature, e.g., low ranks for keywords such as Hollywood movie, new web series india, live cricket. In consideration of the fact that JioCinema has exclusive streaming rights in India for all Hollywood & HBO content and has recently launched critically-acclaimed web series like Murder in Mahim, Ranneeti, this is rather concerning from the acquisition funnel POV. This is an area of improvement where optimization should be done for keywords around recent launches in select content categories, genres and publishers. Articles/ blogs/ press releases with these keywords would be a low hanging fruit to improve SEO

- ❌ JioCinema is missing from the search results of the competition. This must be improved upon as real estate must be captured when users intent isn't too specific. Even when they are searching for movies on hotstar, JioCinema must showcase their content library. To tackle this, JioCinema must bid on competitors

Competitive Positioning

The above data shows that JioCinema is trailing Hotstar in search engine keywords and also in traffic. Cricbuzz has been far ahead on the back of IPL 2024 that was recently concluded. (Time period: MTD June 2024)

Content Loops

JioCinema being at the heart of content, can have multiple avenues for ICPs to discover, watch and engage with content on the platform. The approach would be to provide engaging loops that would entice users to watch content on JioCinema, thus creating intent to watch. Objective is to increase content discovery to acquire more users.

Content Loop Possibilities

Content Loop | Hook | Generator | Distributor |

|---|---|---|---|

YouTube | Behind the Scenes with path-breaking characters | JioCinema's in-house content team | YouTube (via recommendations, Discover, Shorts) Viewer (shared via WhatsApp/ social media posts & DMs) |

Newsletter | Teasers of the upcoming shows & movies | JioCinema's in-house content team | JioCinema's official newsletter emails |

Cliff-hanger scenes of newly launched content | JioCinema's in-house content team | Instagram (Explore tab/ Reels) Viewer (shared via stories/ DMs) |

I will prioritize YouTube content loop as this is the platform where our ICPs would be actively spending more time, and leads to easy organic discovery >> creating intent to watch

Content Loop - Prioritized

Content Loop Details

- Content Creator: JioCinema: The platform, being a subsidiary of the Viacom18 Media house has access to the entire production cycle that is responsible for creating content relevant for the ICPs. Content and production experts can come together to create sneak-peek episodes about marquee shows that generate huge curiosity and fandom such as the Bigg Boss seasons. Elements of the episodes can include themes like the hidden entries of the house, 24*7 camera angles, decision and allocation about tasks, branding elements in the house, live streaming and monitoring of the contestants/ conversations, Weekend Ka Vaar fun with the anchor etc.

- Content Distributor: JioCinema: JioCinema and the Viacom18 house would partner with channels and control all distribution as the episodes would be their proprietary content. The episodes would be hosted on the platform and can be viewed via multiple entry points such as preview on the hero carousel, TV Shows section on the primary menu, Endless Entertainment content trays etc. Episodes would also be uploaded on JioCinema's channel on YouTube

- Distribution Channel: YouTube and Viewer shares: Bigg boss related results would show up on all relevant YouTube search queries, and through recommendations and YT Shorts. While behind-the-scenes episodes can be viewed on YouTube, the links to these can be shared by viewers on WhatsApp and other social media platforms. This would further increase the anticipation for the upcoming shows, trivia about them, in turn increasing the reach of the content loop created on JioCinema

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.